Category: Products

-

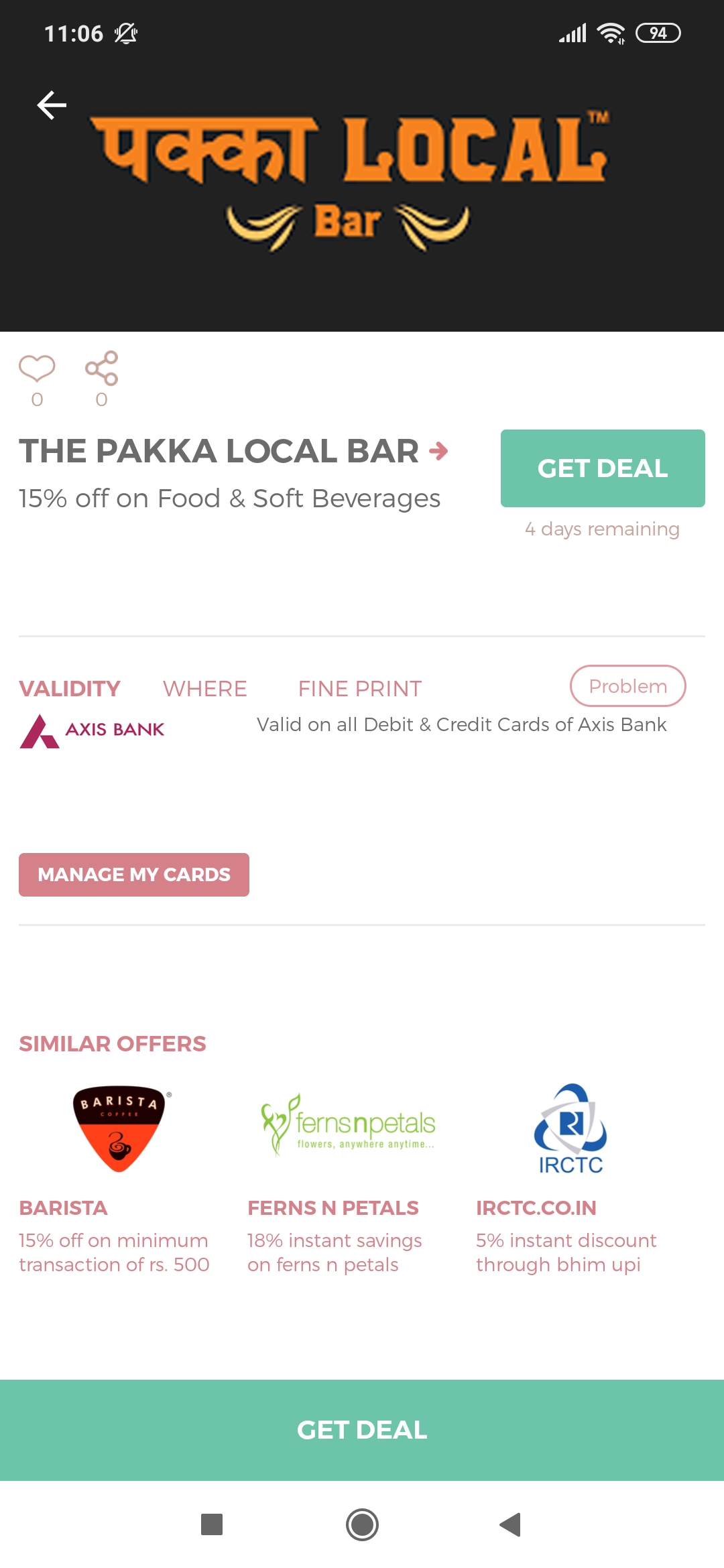

WishFin + mTuzo integration

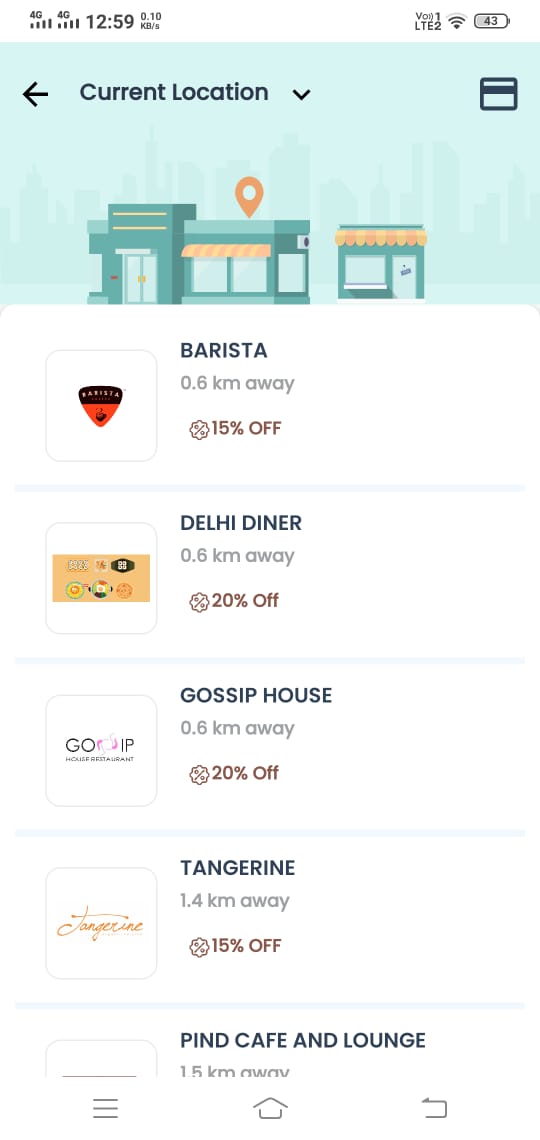

WishFin is a leading marketplace for loans and other financial services. The WishFin app allows consumers to check their CIBIL score for free. mTuzo APIs power Offers-near-me experience for consumers on the WishFin app. They can see the unique offers for their cards, near their current or search location. Download the WishFin app and see…

-

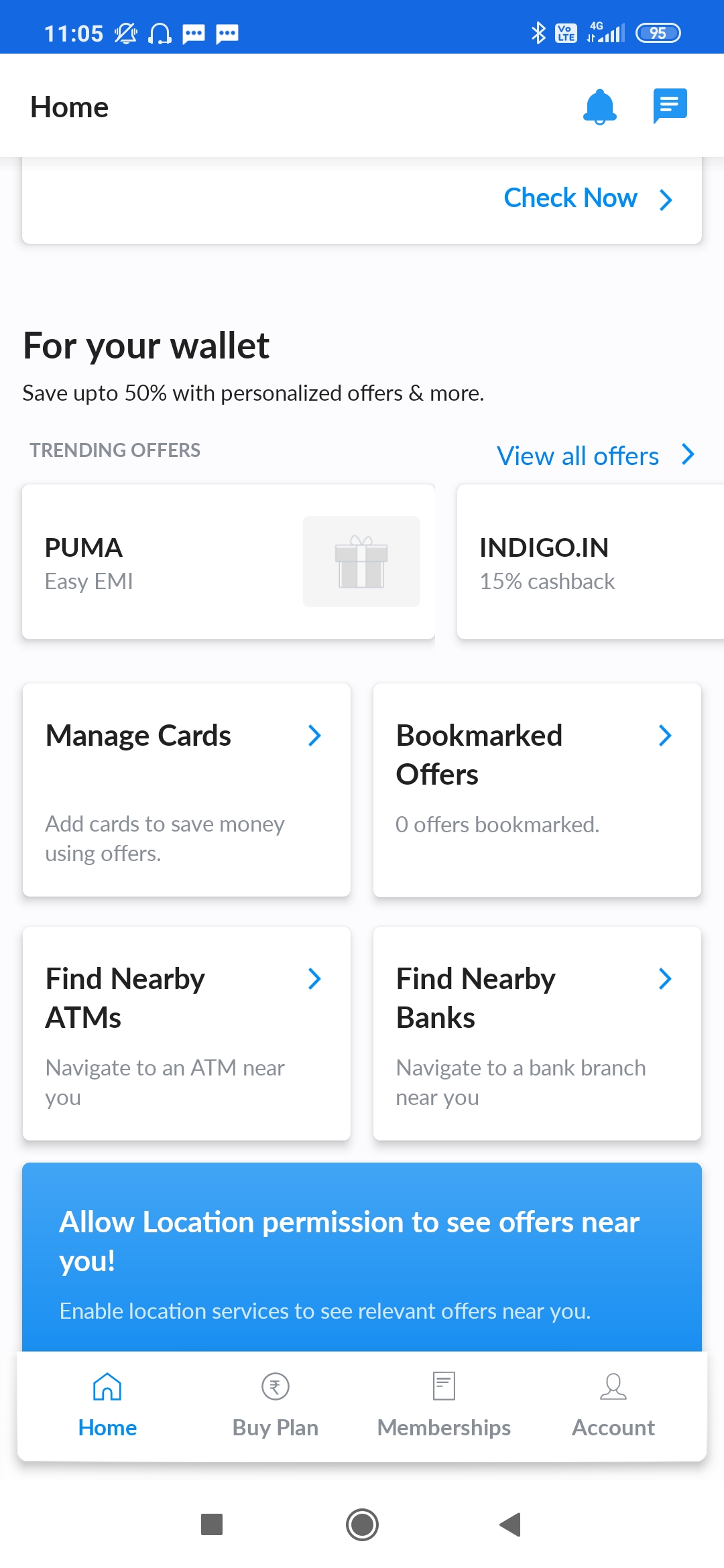

Offers for OneAssist Wallet Assurance customers

One Assist is a leading provider of wallet assurance solutions. As a customer of OneAssist’s wallet assurance solution, the app seeks the customer’s debit and credit card details. mTuzo provides the unique offers valid for these cards in any customer’s virtual wallet. Offers that are aggregated across banks and networks. Download the OneAssist app, buy…

-

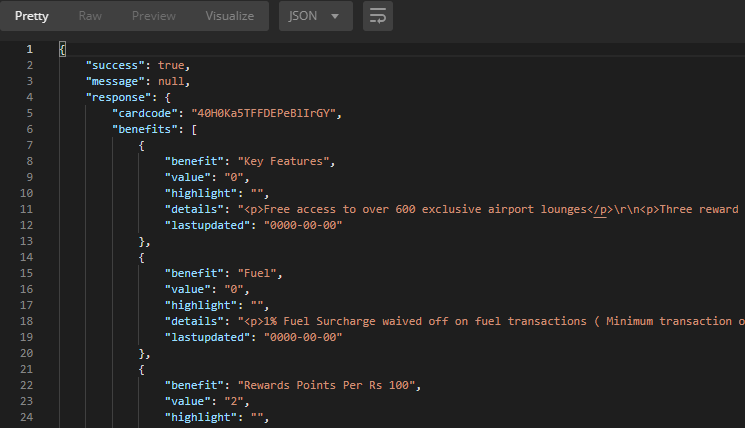

Get Cards Benefits API

Most of the credit and debit cards come with membership benefits including joining benefits, subscriptions, spend based rewards, cash back etc. This API will help you pull out the unique benefits of an individual card including Joining Benefits Annual renewal benefits CashBack (if any) Reward points multiplier Golf benefits Lounge Benefits Travel vouchers API url…

-

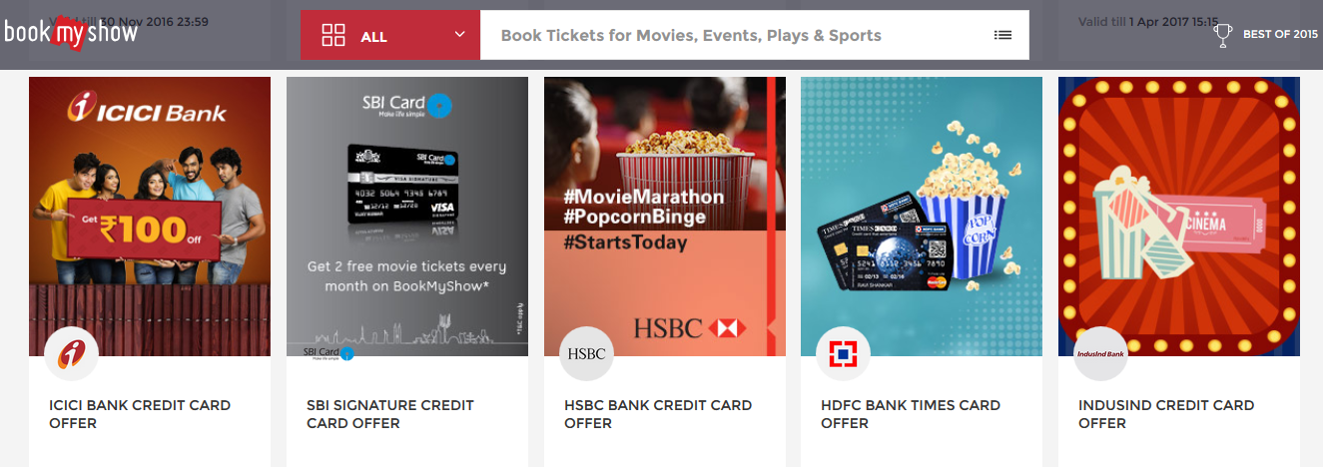

mTuzo Chrome Extension for eComm Offers

A Chrome Extension to showcase your eComm shopping/card offers, may be a good asset in your eComm strategy. Why? Getting a bigger share of your customer’s online spends is a key goal for most banking and payment professionals. In most cases, apart from making it a more convenient and friction-less payment experience, there is usually…

-

mTuzo API integration steps

mTuzo APIs have been designed for not only powering the specific use-cases that drive more spends, but also to ensure that the API integration steps are simple and intuitive. Step 1: Which APIs will I need in my integration? As a first step, we recommend you to identify the exact APIs that would be needed…

-

Offers-Near-ATM

mTuzo APIs can enable a powerful customer journey based on Offers-Near-ATM. The challenge for most debit card issuers is that a big chunk of the “active” portfolio is only ATM active and POS inactive. I.e. the customers use their debit cards only to withdraw cash at ATMs but do not use it for shopping in-stores…